Happy 2nd Birthday, EyesOnTheGoal blog!

Happy 2nd Years of the Financial Independence (FI) in 5years Goal!

Happy 7th Year living in Berlin, Germany!

Happy Net Worth Growth despite a 6-month sabbatical and part-time work!

Putting time in perspective

Just when I was feeling blocked and demotivated I stumbled upon the magnificently eye-opening article Putting time in perspective on WaitButWhy. It inspired me to put my life events on a timeline. I realized that it’s actually not that long since I set this ambitious FI Goal in motion – it’s only been 2 years. What felt like an eternity is a very small part of my life (6%). It’s not even half of high school or university. 2 years is a long time but not that long as to make tremendous progress on such a bold goal.

Putting things into perspective relieved me. I am on a journey. A journey that takes years. There’s an approximate direction, but no real turn-by-turn instructions. The map is very blurry. I pass through the Frugality valley and the Employment plateau, and the Sabbatical highs, through the “What the hell do I do with myself” boulevard, Self-Learning highway and I got lost in the Side Projects dark forests. And that’s the fun of it – it’s full of possibilities mixed with a big dose of uncertainty.

I’ve had the goal on the back of my mind for my whole life, but it was only in Nov 2016 when officially started working on it. I’ve been experimenting ever since. I’ve done things never imaginable for me before: started an investment portfolio, took a 6-month sabbatical, branched into blogging and photography, tried a nomad lifestyle and didn’t like it, moved to a part-time employment, just to name a few.

Gimme numbers

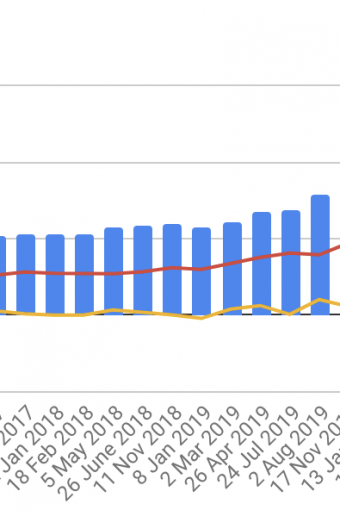

That’s how my net worth developed since I measure it. Exactly in the middle of the chart is FI Goal Start (Nov 2016).

I started investing in the stock market in 2015 and ever since I’ve been following a monthly saving strategy. The market has been predominately growing since 2015, hence the nice upward curve. You can clearly see the dip in

Numbers since FI Goal start (2years)

– 25% net worth growth

– 33% saving rate*

Numbers all times (since 2015, 4years)

– 101% net worth growth

– 42% saving rate*

– 24% stock investment growth

*measured with the Toshl app – a great tool to keep everything in place.

The original plan

My original goal was to reach €300k investments which will yield €12k (4%) yearly return or €1k a month. This is my estimation of the absolute basic expenses covering my rent, food, health, utilities, etc. This meant that in order to reach €300K, I will need to save €2K every month for 4 years and 10months.

Ok, I give you that – the plan was way too optimistic. On one hand, I will need much more than €300K if I wanted a life beyond the basics. On the other hand, if I lived beyond a basic life, I couldn’t possibly save €2K for almost 5 years straight.

One thing became clear – the €300K is just the first milestone. I will need much more – how much I don’t know. For now, I leave it open, and I focus on the goal at hand.

What was great

I am debt free and relatively flexible when it comes to finances. I am in good health and energy and I have what seems like a long runway in front of me to work on the goal.

I am learning a lot about myself and the world! It’s since I dared to step off the beaten path that all new possibilities started to open up.

It’s amazing to have 4 years worth of personal finance data, so I can analyze and see where I really stand. I’ve constantly been updating and tweaking it and now it pays off. What used to be a blur, now is very clear.

I had 2 rich years full of travels, adventures, eye-opening experiences. Oh, and yes, I still want to do this hot air balloon flight I aimed at 2years ago!

What is to improve

I often lose motivation for the blog and for building the side projects. That’s an ongoing struggle. I’m establishing now a regular schedule including gym and dedicated deep work times – I’ll keep you updated on this one.

My income and saving rate has dropped because of all the travel and self development I did + the sabbatical. I’ll write this off as investment in myself. But I do need to find a balance there.

My biggest source of income is still my employment. I do experiment with a few side projects, but I haven’t put enough time and attention for them to generate any real income.

The goal evolves

Between crunching numbers, traveling and living I’ve been doing a lot of self-reflection and as a result, the pure FI goal transformed into the less tangible but much more meaningful goal of finding what I really enjoy and want to do with my life. There have been hiccups, and disappointments and loss of motivation but here I am writing again.

66 posts down the road, I have a better idea of what I’m doing, where to get inspiration from and what I like to write about.

That’s the main reason I set up this blog – to keep my eyes on the goal. I made commitments and I described my dream life, and now I had to follow through. The blog is like a safety net – no matter how often I fall, it embraces me and catapults me back to the skies. The extra benefit of the blog is that writing helps me clear my mind and work through my thoughts and emotions.

******

How about you? What did you learn in the past 2 years? What direction is your life going?

******

Head photo by fotogestoeber

Hot air balloons photo by ian dooley on Unsplash

Thanks for your courage, commitment, openness and transparency. All of which are actually Agile values.

You are truly an inspiration, Kate.

Greetings from Cairo,

Ricardo

Obrigada, Ricardo! I do keep the agile values alive. 🤘🦄🙌

It was actually you who introduced me to the expense tracking app Toshl and shared your financial planning experience back in the early 2010s :))) So, I thank you for fuelling my FIRE🔥

FIRE = Financial Independence, Early Retirement

Great to see you back and going strong!

I like your blog and every time a see a new post I am excited to read it.

I shared this article on FIREhub.eu

It’s motivating to see your statistics like net worth grow – I should this as well (I only track my savings rate and measure my approximative net worth a few times per year)

Thanks Noemi!

Congratulations on your journey so far!

I think it is more than natural that goals evolve as you make progress. It’s fantastic to read about your learnings along the way and how you improved your approach!

Keep going!

All the best for 2019 and beyond!

Danke Herr Meine Finanzielle Freiheit 😉

Good to (blog) meet you. Guten Rutsch ins neue Jahr!

🙂

Congrats! Your article is our Blog Post of the Month – December 2018 on FIREhub.eu.

https://firehub.eu/blog-post-of-the-month-december-2018/

Yuhuuuuu! 🤘🙌😎Thanks Noemi.

That’s fantastic news to start 2019 with.

Thank you so much, Kate. This is a pure inspiration source! <3