This is post #7 from the 30 Day Personal Finance Challenge: Boost Your Financial Health with a Daily Tip!

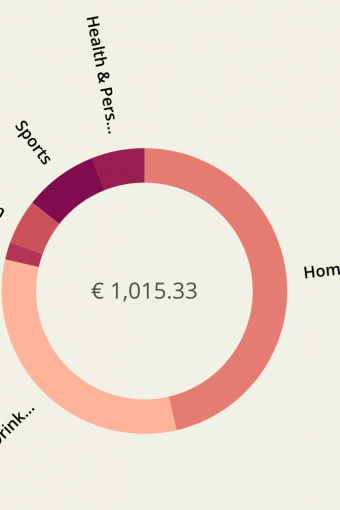

Now that you know where your money goes, you probably have a very clear idea of your monthly budget. This is the total sum of all you need to cover your monthly expenses – rent, bills, credit/mortgage payments, insurance, entertainment, subscriptions, etc. Check here for the categorization I use.

In an ideal world, you will have a constant inflow of money. You will be able to cover your expenses. We don’t live in an ideal world, so to save yourself from trouble, you need to build an emergency fund.

An emergency fund is a stash of money set aside to cover the financial surprises life throws your way.

Usually, the emergency fund needs to contain enough money to cover at least three months of living expenses.

Make this goal number one! Before you have it set up, it is not advisable to undertake any financial operations.

What are the benefits?

- You will be prepared no matter what comes your way – unemployment, medical or dental emergency, need to support a family member, broken roof, burned house, etc. No matter what happens, you are safe… for at least 3months.

- You will be able to make smarter financial decisions because you won’t be under pressure.

- If you suffer from unbearable work conditions, you can much easily take the leap and give yourself the time to figure something else out.

- You will have the courage to take bolder life decisions. Yeaaay to that!

- You will enjoy better sleep, better skin, and better sex. I can’t prove the last 2, but it’s worth trying.

How to build my emergency fund?

The fund needs to be in a separate account from your checking account. It should be liquefiable but not so easy as to encourage your impulsive purchases.

Who needs an emergency fund when I can buy a Prada bag (replace with your item of choice)?

Depending on how much you are able to save, building an emergency fund will take you anything from a few months to more than a year. Set a monthly automatic transfer and start building the fund.

If you already have enough put aside, congratulations! You are one of the few lucky ones! You can still move the exact amount to a separate account to prevent yourself from spending the fund.